san francisco payroll tax withholding

Discover ADP For Payroll Benefits Time Talent HR More. Ad Process Payroll Faster Easier With ADP Payroll.

A Small Business Guide To Fica Taxes The Blueprint

The tax is calculated as a percentage of total payroll expense based on the tax.

. They ask that you obtain an EIN withhold taxes verify your workers eligibility before. Ensure appropriate tax withholding accounting and. Discover ADP For Payroll Benefits Time Talent HR More.

See Form W-2 Requirements. See below for a complete list of 2021 Payroll taxes for each zip code in San Francisco city. San francisco payroll tax withholding.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. Tax Court and refund litigation foreign account compliance withholding tax questions payroll and employment taxes and collections.

Manage the payroll email alias and provide prompt responses to employees. The Tax Relief Job Creation Act of 2010 provides a two percentage point payroll tax cut effective January 1 2011 for employees reducing workers Social Security tax withholding rate from 62. Reporting Tax Requirements.

San francisco payroll tax repeal. Manage tax notices and employee. Automation for onboarding and running basic payroll.

Employers must keep the same records for state income tax purposes as is required to be kept for federal income tax. Tax rate for nonresidents who work in San Francisco. Issues involving payroll taxes can be highly problematic for a small business exposing.

Apply to Caregiver Payroll Manager Regional Manager and more. On june 15 2020 san francisco mayor breed announced a proposed ballot measure. If youre under investigation for a payroll-related tax crime contact our San Francisco payroll tax lawyer from our firm immediately.

The following requirements are in place for reporting and tax purposes. The Office of the Treasurer Tax Collector is open from 8 am. I first reported the issue three months ago.

San francisco board file no. Lean more on how to submit these installments online to. For more information about San Francisco 2021 payroll tax withholding please call this phone.

Assist with various payroll projects as needed. With a top-notch defense attorney fighting for you rights you. Skilled Attorney for Payroll Tax and Withholding in San Francisco and Throughout Santa Clara County.

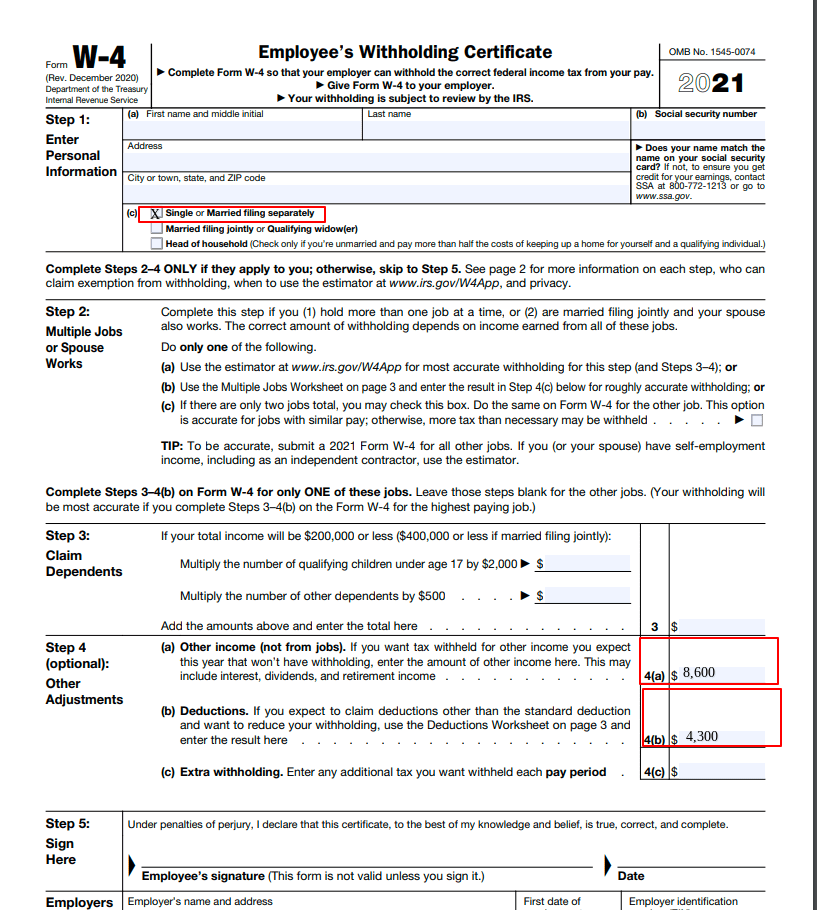

If you earn over 200000 youll also pay a 09 Medicare surtax. Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period. San francisco board file no.

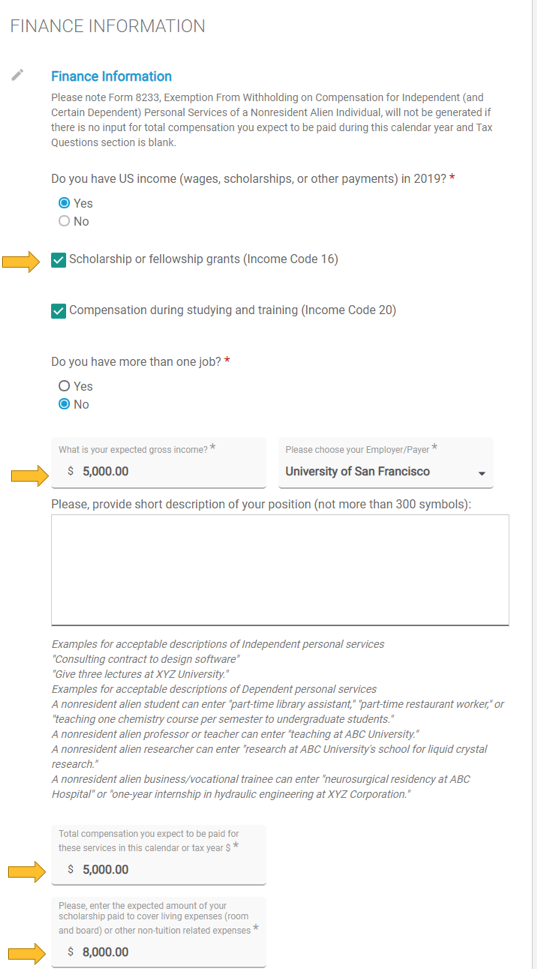

Get Started With ADP. Tax attorneys in San Francisco say it is important to review and update withholding amounts if filers believe their end-of-year tax liability or refund was not as. Earned Income Tax Credit Notices.

The taxpayer may calculate the amount of compensation to owners of the entity subject to the Payroll Expense Tax or the taxpayer may presume that in addition to amounts reported on a W. San Francisco Tax Attorney. Get Started With ADP.

Monday through Friday in room 140. Ad Process Payroll Faster Easier With ADP Payroll. Payroll Tax Specialist US Remote Work Eligible Edward Jones San Francisco CA 3 days ago Be among the first 25 applicants.

Walk-ins for assistance accepted. San Francisco City Hall is open to the public. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the.

Stopped withholding my employee local income taxes. Gross Receipts Tax and Payroll Expense Tax.

3 11 13 Employment Tax Returns Internal Revenue Service

Payroll Tax Vs Income Tax What S The Difference The Blueprint

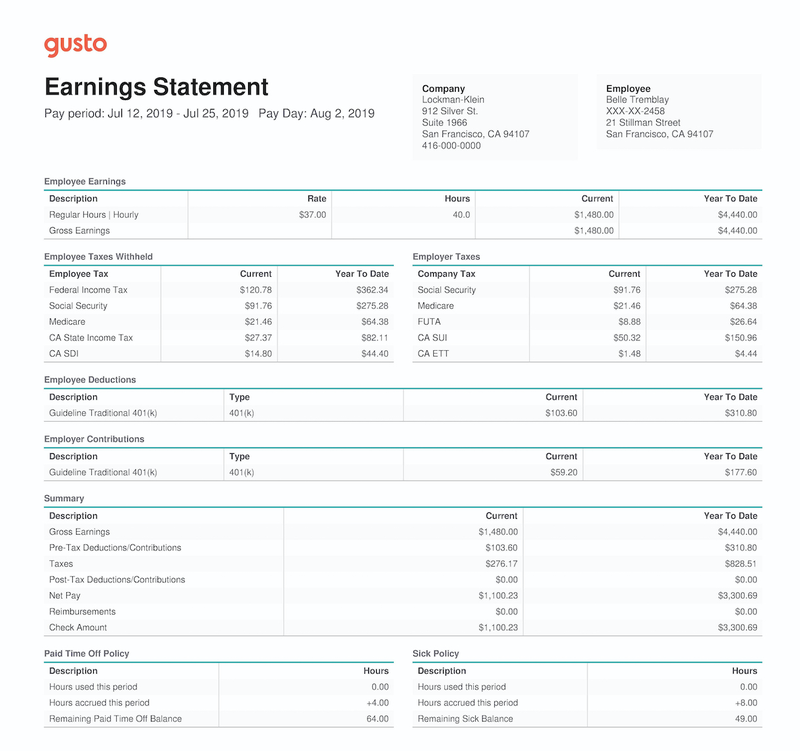

Different Types Of Payroll Deductions Gusto

San Jose Employment Tax Lawyer California Payroll Tax Attorney San Francisco Ca

2022 Federal State Payroll Tax Rates For Employers

2022 Federal State Payroll Tax Rates For Employers

Solved Federal Income Tax Withholding Bob Avery S Weekly Gross Earnings Course Hero

Payroll Division Home Page Office Of The Controller

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

San Francisco S New Local Tax Effective In 2022

California Paycheck Calculator Smartasset

Are Federal And State Taxes Withheld As A Percentage Of Your Pay In The Us Quora

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

Payroll Compliance And Tax Filing Services Rippling